How to Finance a New Roof: Practical Options to Save Now

So, you need a new roof. It's one of those big-ticket home projects that can feel completely overwhelming, especially if it's an unexpected expense after a nasty Texas hailstorm. But don't panic. The first step is just figuring out how you're going to pay for it, and you’ve got more options than you might think.

Your Starting Point for Financing a New Roof

Here in Dallas-Fort Worth and East Texas, we know that the need for a new roof often comes out of nowhere. One minute it's just another storm, the next you're looking at leaks and damage. The good news? The roofing industry has really stepped up to make financing accessible, even on short notice.

It's a booming business. The U.S. roofing industry was worth a massive $23.35 billion in 2023, and that number is expected to keep climbing. For homeowners, this growth means you have choices. In fact, about 75% of roofing companies now offer their own financing plans, and many can get you approved in less than a day.

At Hail King Professionals, we've been helping DFW homeowners navigate this process since 1991. We've built our financing options specifically for storm victims, offering things like no-prepay plans and soft credit checks so you can see your options without dinging your credit score. If you're curious about the market, you can dig into some recent roofing industry statistics to see just how much has changed.

Quick Comparison of New Roof Financing Options

To help you get a clear picture, here’s a quick side-by-side look at the most common ways Texas homeowners finance a roof replacement. We’ll break down the pros, cons, and who each option is really for.

| Financing Option | Best For | Typical Interest Rate | Impact on Home Equity |

|---|---|---|---|

| Insurance Claim | Storm or hail damage where coverage applies. | Not applicable (your deductible is the primary cost). | None. |

| Contractor Financing | Fast approval and convenience, often with minimal credit impact. | Varies; often 0% introductory offers or competitive rates. | None, as it’s typically an unsecured loan. |

| Personal Loan | Homeowners with good to excellent credit seeking a straightforward loan. | 6% – 36% depending on credit score and lender. | None. |

| HELOC | Large, multi-part home improvement projects; lower interest rates. | Variable rates, typically tied to the prime rate. | Uses your home as collateral, reducing available equity. |

This table gives you a great starting point, but every situation is unique. The key is to find the path that feels right for your budget and timeline.

The numbers don't lie: An estimated 85% of financed roofs are boosted by insurance claims, which can cover 70-90% of the cost after a storm. This often leaves homeowners financing a smaller gap of just $2,000-$5,000, making the project far more manageable.

Getting a Real-World Number for Your New Roof

Before you even think about financing, you need a solid, realistic number to work with. A vague, back-of-the-napkin guess just won’t do when you're planning a major home project. In Dallas-Fort Worth and East Texas, the final price for a new roof is shaped by several key factors that go well beyond the square footage.

Getting a handle on these variables is the first, most crucial step. It helps you figure out exactly how much financing you need and saves you from the sticker shock of surprise costs popping up mid-job.

More Than Just Shingles

The single biggest piece of the cost puzzle is, of course, the material you pick. While standard architectural asphalt shingles are a solid, popular choice, a lot of homeowners around here are making a smart upgrade.

- Impact-Resistant (Class 4) Shingles: In "hail alley," these are a godsend. They do cost more upfront, but they can dramatically cut down on future repair bills and often earn you a nice discount on your homeowner's insurance.

- Metal Roofing: If you're thinking long-term, metal is tough to beat. It's known for its incredible lifespan and energy efficiency. The initial investment is higher, but the return over the decades is fantastic.

- Specialty Materials: If you're going for a specific look, premium options like slate or tile can seriously boost your home's curb appeal, but they also come with a much higher price tag.

The shape of your roof is a big deal, too. A straightforward ranch-style home with a single peak is a much quicker job than a two-story house with steep slopes, multiple dormers, and intersecting valleys. Every one of those features adds labor time and complexity, and that will show up in your quote.

Don't Forget the Extras

A roof replacement is almost never just about the shingles. There's a whole list of other services that are often required to do the job right, and you’ve got to factor them into your total cost. Otherwise, your financing might fall short.

Take solar panels, for example. They have to be carefully detached before the old roof comes off and then reinstalled after. This is a specialized job with a significant cost. In fact, some solar companies might offer a "free" roof, but they're really just bundling that cost into the price of the solar installation—you're still financing it. To see how these things add up, you can learn more about how much a new roof costs in our detailed guide.

A transparent, line-by-line estimate is non-negotiable. If a contractor hands you one lump-sum price without breaking down materials, labor, permits, and other fees, that’s a major red flag. You need that detailed breakdown to compare apples to apples with other quotes and to give lenders the documents they’ll ask for.

Things like dumpster rentals, city permits, and especially decking replacement (if the wood underneath is rotten) have to be on your radar. If a storm is what kicked off this whole process, you can bet there might be hidden damage that only becomes clear after the old shingles are torn off. When you're calculating the costs after a storm, knowing the ins and outs of the insurance process is critical. These water damage insurance claim tips can be a huge help in maximizing what your policy covers.

A good, trustworthy contractor will always get in your attic and check the decking before giving you a final number. That little bit of upfront diligence gives you a much more accurate quote and makes the entire financing and installation process go a whole lot smoother.

Your Roof Financing Playbook: A Detailed Look at the Options

Alright, you've got a detailed, itemized quote from your roofer. Now comes the real question: how are you going to pay for it? This is where we match the project's price tag with a funding strategy that fits your budget and timeline. Let’s walk through the most common ways homeowners in Dallas-Fort Worth and across East Texas tackle this.

Starting with Your Homeowner's Insurance

For so many of us here in Texas, the whole conversation about a new roof starts with a hailstorm. If your roof is damaged because of a storm, your first stop should always be your homeowner's insurance policy. This isn't a loan; it's a claim against the coverage you've been paying for.

The process usually involves getting a professional inspection, filing the claim, and then meeting with an insurance adjuster. A good, honest roofer is your best advocate here—they can point out damage the adjuster might overlook. The goal is to get your insurance to cover the lion's share of the replacement cost, leaving you to handle just the deductible and any upgrades you decide to add.

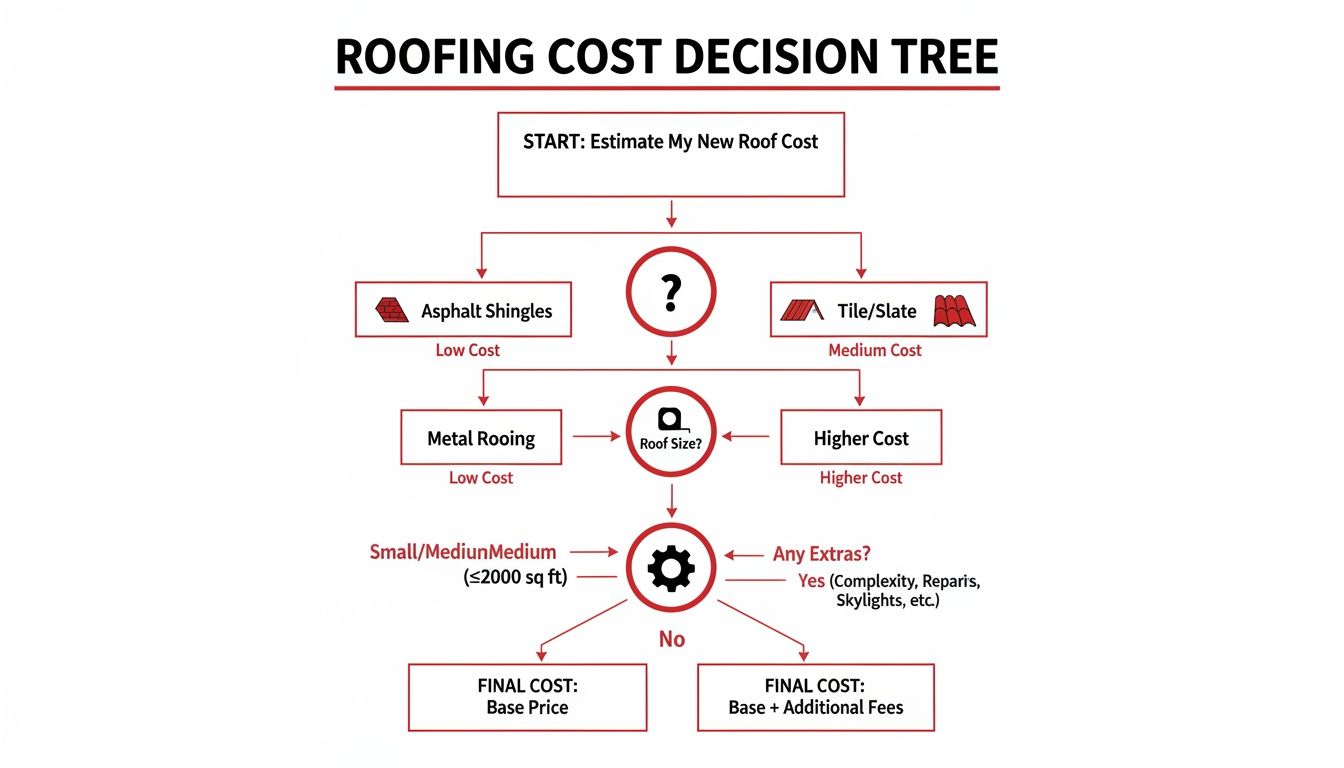

This flowchart breaks down exactly what goes into that final price tag you need to finance—the materials, your roof's size, and any extras.

Knowing where the costs come from helps you understand what your financing needs to cover from start to finish.

Exploring Contractor Financing

One of the most straightforward paths is financing directly through your roofing contractor. Many established companies, including us at Hail King Professionals, have relationships with lenders who know the home improvement business inside and out. This route is all about speed and simplicity.

A huge plus here is the soft credit check for pre-qualification. You can see what kind of loan terms you might get without a "hard pull" on your credit report, which can ding your score. These loans are also typically unsecured, which means you aren't putting your house on the line as collateral.

In-house financing is designed to get past common roadblocks. It means no lien on your property, usually no penalty for paying it off early, and a clear process that can get you funded in as little as 24-48 hours.

That kind of speed is a game-changer when you're staring at an active leak or just trying to get the job done before the next storm season rolls in.

Tapping into Your Home's Equity

If you've been in your home for a while and have built up some equity, a Home Equity Line of Credit (HELOC) or a home equity loan can be an incredibly smart move. You're essentially borrowing against the value you already own in your property.

A HELOC acts a lot like a credit card—you get a credit limit and only pay interest on the money you actually use, which is perfect for projects where the final cost might shift a bit. A home equity loan is different; you get the full amount upfront in a lump sum with a fixed interest rate.

There's a lot of potential in using home equity to pay for home improvements, but it's important to go in with your eyes open. The big thing to remember is that your home is the collateral. If you can't make the payments, your property is at risk.

Other Paths: Personal Loans, Government Programs, and More

A traditional personal loan from a bank, credit union, or online lender is another solid option. Like contractor financing, these are usually unsecured, and your approval hinges on your credit score, income, and overall debt.

- Who Qualifies? Lenders typically want to see good-to-excellent credit (think scores of 670 or higher) to offer you their best interest rates.

- What are the Rates? They can be all over the map, from as low as 6% for applicants with stellar credit to over 30% if your credit profile is on the weaker side.

- How's the Application? You'll need to provide documents like pay stubs and tax returns. Getting the funds can take anywhere from a few days to a week.

Personal loans give you a fixed monthly payment, which makes budgeting predictable and simple.

You can also look into government-backed programs. An FHA 203(k) loan, for example, lets you bundle the cost of home improvements into your mortgage. These are definitely more complex and come with more red tape, but they can be a fantastic tool if you're buying a fixer-upper. It's also worth a call to your local utility company—some offer grants or special low-interest loans for installing energy-efficient roofing materials.

The global roofing market is booming, growing from $213.76 billion in 2023 to a projected $280.29 billion by 2029. This means more competition and better financing options for homeowners, like 0% introductory APR deals and streamlined FHA 203(k) loans that can cover up to $35,000 in repairs. In storm-heavy areas like DFW, this leads to more flexible options designed to work smoothly with insurance claims.

To give you a clearer picture, I've put together a table comparing these main options side-by-side.

Detailed Financing Method Breakdown

This table offers an in-depth look at the key financing methods, comparing their eligibility requirements, application complexity, and potential long-term costs to help you decide.

| Method | Credit Impact | Typical Loan Term | Key Consideration |

|---|---|---|---|

| Contractor Financing | Soft pull for pre-qual, hard pull to finalize. | 2–10 years | Speed and convenience are the biggest draws. It's built for roofing projects. |

| Personal Loan | Hard inquiry during application. | 3–7 years | Good credit is key to getting a low, fixed interest rate. |

| HELOC | Hard inquiry. Increases total debt tied to your home. | 10-year draw, 20-year repayment | Variable interest rates can be risky, but the flexibility is a major plus. |

| Home Equity Loan | Hard inquiry. Adds a second mortgage payment. | 5–20 years | Your home is the collateral, but you get a predictable, fixed-rate loan. |

| Credit Card | Hard inquiry for new card; increases utilization. | Revolving | Best for smaller projects or if you can use a 0% intro APR offer and pay it off quickly. |

| Government Loans | Hard inquiry; extensive documentation required. | 15–30 years | The process is slow and complex but can be a great option for major renovations. |

Choosing the right financing comes down to your personal financial health, your timeline for the project, and your comfort level with different types of risk. Take your time, compare offers, and don't be afraid to ask your roofer for their recommendation based on what they've seen work for other homeowners.

How to Navigate the Application and Get Funded

Alright, you’ve done the hard work of weighing your options and have a financing path in mind for your new roof. Now it's time to make it happen. This is where we shift from planning to action—gathering your documents, submitting the application, and getting the funds lined up so we can get your project on the schedule.

The key to a smooth process is preparation. Lenders are looking for a clear and stable financial picture before they’ll sign off on a loan. If you know what they need ahead of time, you can cut through the red tape and dramatically increase your chances of getting approved with great terms.

Assembling Your Application Toolkit

Think of this as building a small portfolio of your financial health. Every document you provide helps the lender understand your situation and feel confident in your ability to handle the new payment. Your goal is to give them a complete, organized package that makes their decision a no-brainer.

You'll almost always need a few key items:

- Proof of Identity: A driver’s license or another government-issued photo ID is a must.

- Proof of Income: Typically, this means your most recent pay stubs, W-2s, or the last two years of tax returns if you're self-employed.

- The Contractor's Estimate: Lenders need to see a detailed, official quote from your roofer. This justifies the loan amount and shows them it's for a legitimate home improvement project.

- Proof of Homeownership: A copy of your property deed or a recent mortgage statement will do the trick.

Pro-Tip: Scan these documents and save them in a dedicated digital folder. When a lender asks for something, you can attach it to an email in seconds instead of scrambling to find it.

The Power of Contractor Financing Partners

This is where working with a contractor who offers integrated financing, like we do here at Hail King Professionals, really simplifies things. Our lending partners work exclusively on home improvement loans, so they get the unique needs of a roofing project.

One of the biggest perks is the soft credit check for pre-qualification. This lets you explore potential loan offers without the formal "hard inquiry" that can ding your credit score. It’s a completely risk-free way to see what you qualify for.

Picture this: a nasty Texas hailstorm just rolled through Dallas-Fort Worth, and you're looking at a damaged roof. It’s no surprise the U.S. roofing industry has swelled to $99.8 billion, largely because of demand in storm-prone areas like ours. With over 106,000 roofing businesses out there, this competition has fueled better and more accessible financing to help homeowners recover quickly. You can see more about roofing contractor market trends on IBISWorld.

Once you pick an offer, the full application is usually just a simple online form. Because our lending partners are already familiar with our work and pricing, the entire approval-to-funding timeline gets compressed. That means less waiting around and a much faster start for your project. If you're also adding solar, be sure to check out our guide on navigating solar panel roof replacements, as that adds a few extra considerations.

From Application to Funding

So, how long does this all take? Once your application and all the documents are in, the countdown begins.

With contractor-facilitated financing, it's not uncommon to get an approval decision in just a few hours. The money itself often follows within 24 to 48 hours. The funds are usually paid directly to the contractor as project milestones are hit, so you don’t have to worry about managing large sums of money.

If you go the route of a personal loan or HELOC from a bank, be prepared for a slightly longer wait—anywhere from a few days to a couple of weeks. This is exactly why it’s so critical to get the financing process started the moment you choose your contractor. A delay in funding can mean a delay in getting the work started, and that’s the last thing you want when your home is vulnerable.

Managing Your Investment After the Roof Is On

It’s a great feeling to see that beautiful new roof finally installed. The hard part is over, right? Mostly. Now your focus shifts from getting the project done to managing your new financial commitment and protecting the asset you just created. A little smart planning now will make sure your investment pays off for years.

First things first, let's talk about that new payment. The easiest way to handle it is to fold it right into your existing monthly budget. Just add it as a new line item next to your mortgage and utilities. It’s a fixed number, which makes it predictable and easy to plan for, taking the stress out of the equation.

Think of it this way: you didn’t just fix a leak. You actively invested in your home's value and safety, and that monthly payment is how you're building that equity.

Unlocking the Long-Term Financial Benefits

A new roof isn't just a necessary repair; it’s one of the smartest upgrades you can make to your home, delivering a real return on your investment from a few different angles. Sure, it makes your house look great from the street, but the financial perks are where the real story is.

Ask any real estate agent—a new roof is a huge plus for potential buyers. In many cases, it can boost a home's resale value by $15,000 or more. It’s common for homeowners to recoup over 60% of the project's cost when they sell. It sends a clear signal that the home is well-maintained and saves the next owner from a massive future expense.

Your investment goes beyond aesthetics. A high-quality, professionally installed roof provides tangible savings month after month, effectively helping the project pay for itself over time through reduced homeownership costs.

Here in DFW and East Texas, that return gets even better. By choosing impact-resistant Class 4 shingles, for example, you can often land a hefty discount on your homeowner's insurance premiums—sometimes up to 35%. On top of that, a modern, well-ventilated roof keeps your attic cooler, which means your AC doesn't have to work as hard, trimming down those brutal summer energy bills.

Protecting Your Financed Asset

You’ve invested in a top-quality roof, so now it’s all about protecting it. A little proactive maintenance goes a long way in making sure you get every penny of value out of your financing.

You don't need to be a roofing expert to keep things in good shape. A few simple habits can stop small issues from turning into major headaches:

- Keep Your Gutters Clear: Clogged gutters are a roof's worst enemy. Water backs up and seeps under the shingles, leading to rot and leaks. Make it a point to clean them out twice a year, especially after all the leaves drop in the fall.

- Do a Walk-Around After Storms: Once the weather clears up, take a quick look from the ground. Can you spot any missing shingles, bent flashing, or big branches on the roof? Catching this early is key.

- Schedule a Professional Check-up: Every few years, it’s a good idea to have a pro come out and take a look. They can spot subtle signs of wear and tear that are easy to miss from the ground.

These simple steps help ensure your roof lasts as long as it's supposed to. If you invested in premium materials, understanding their specific needs is even more important. You can see what we mean by exploring the impressive longevity of materials like slate in our detailed guide. Proper care turns a necessary expense into a smart, long-term asset for your home.

Answering Your Top Roof Financing Questions

Once you start digging into how to finance a new roof, it's natural for a few questions to pop up. It’s a big investment, after all, and you want to be sure you're making the right calls. We get these questions all the time from homeowners across Dallas–Fort Worth and East Texas, so let's clear up some of the most common ones.

Can I Finance a New Roof with Bad Credit?

The short answer is yes, you often can. While a high-street bank might turn you away, many reputable roofing contractors work with lenders who specialize in home improvement loans. They're used to seeing a wider range of credit scores and often have programs built for homeowners who don't have perfect credit.

The main difference you'll see might be in the interest rate or the loan terms you're offered. But the whole point of these programs is to make sure you can afford essential work, like a new roof, without having to wait.

Pro Tip: Always ask for a soft credit check to get pre-qualified. This lets you see what you’re eligible for without dinging your credit score. It's a no-risk way to understand your options.

Should I Just Sign My Insurance Check Over to the Contractor?

Absolutely not. This is a huge mistake that we see people make, and it can cost you all of your leverage. You should never just endorse the insurance check and hand it directly to your roofer.

Insurance companies typically pay in two installments:

- Actual Cash Value (ACV): This is the first check you’ll get. It covers the depreciated value of your old roof.

- Recoverable Depreciation: This second check is only sent after your contractor proves the job is done and meets the insurance company's requirements.

The smartest move is to deposit the insurance check into your own bank account. Then, you pay your contractor in stages as work is completed, just as you agreed in your contract. This keeps you in control of the money and the project. And if the insurance payout doesn't quite cover the full cost—say, for upgrades or your deductible—financing is the perfect way to cover the difference.

What Questions Should I Ask a Contractor About Their Financing Options?

Asking the right questions upfront is the best way to avoid nasty surprises down the road. A trustworthy contractor will have no problem giving you clear, honest answers.

Before you sign anything, make sure you ask these questions:

- Do you use a soft or hard credit check to pre-qualify me? You want a soft check so your credit score isn't affected while you're just looking.

- Are there any penalties if I want to pay the loan off early? You should always have the option to pay it off ahead of schedule without getting hit with extra fees.

- What kind of interest rates and loan terms can I expect? Ask for the full range, from 0% APR deals to longer-term payment plans.

- Will this financing put a lien on my home? Many contractor financing plans are unsecured loans, which means your house isn't on the line as collateral. This is a major plus compared to a HELOC.

- How long does the whole application and funding process take? You need to know this timeline so you can schedule your roofing project without any frustrating delays.

Does Financing Cover Extras Like Gutters or Solar Panels?

Yes, it can! Good home improvement financing is designed to cover the entire project, not just the shingles. When you’re working with a full-service contractor, you can bundle everything into one straightforward loan.

We regularly help homeowners roll in other services, such as:

- Brand new gutters and downspouts

- Replacing window screens that were damaged in the same hailstorm

- Fresh exterior paint to go with the new roof

- Safely detaching and reinstalling rooftop solar panels

Bundling everything into one financing plan makes life so much easier. You’ll have a single, manageable monthly payment for a total exterior makeover instead of trying to juggle a half-dozen different bills. When you get a quote, be sure to ask how everything is broken down, especially if you're including a major upgrade like solar.

Ready to find a financing solution that works for you? Hail King Professionals offers flexible financing options with soft credit checks and no prepayment penalties, designed to make your roof replacement simple and affordable.